Living standards is now a democracy-defining issue. Voters who can’t afford a decent life are turning away from Labour and in many cases from democracy itself. To make people believe in democracy again and vote for us, we need to make them better off. It is as simple as that. We have three living standards levers we can pull to make voters better off: costs, wages, and social security payments. These levers have different impacts on different groups of voters. Investing to lower costs helps all households (with the greatest impact at the bottom), rising wages helps middle-income households the most but has less effect on low-income voters, and higher social security payments helps low-income households. If we want to get living standards up for everyone, and win the next election, we need to pull all three levers.

Costs

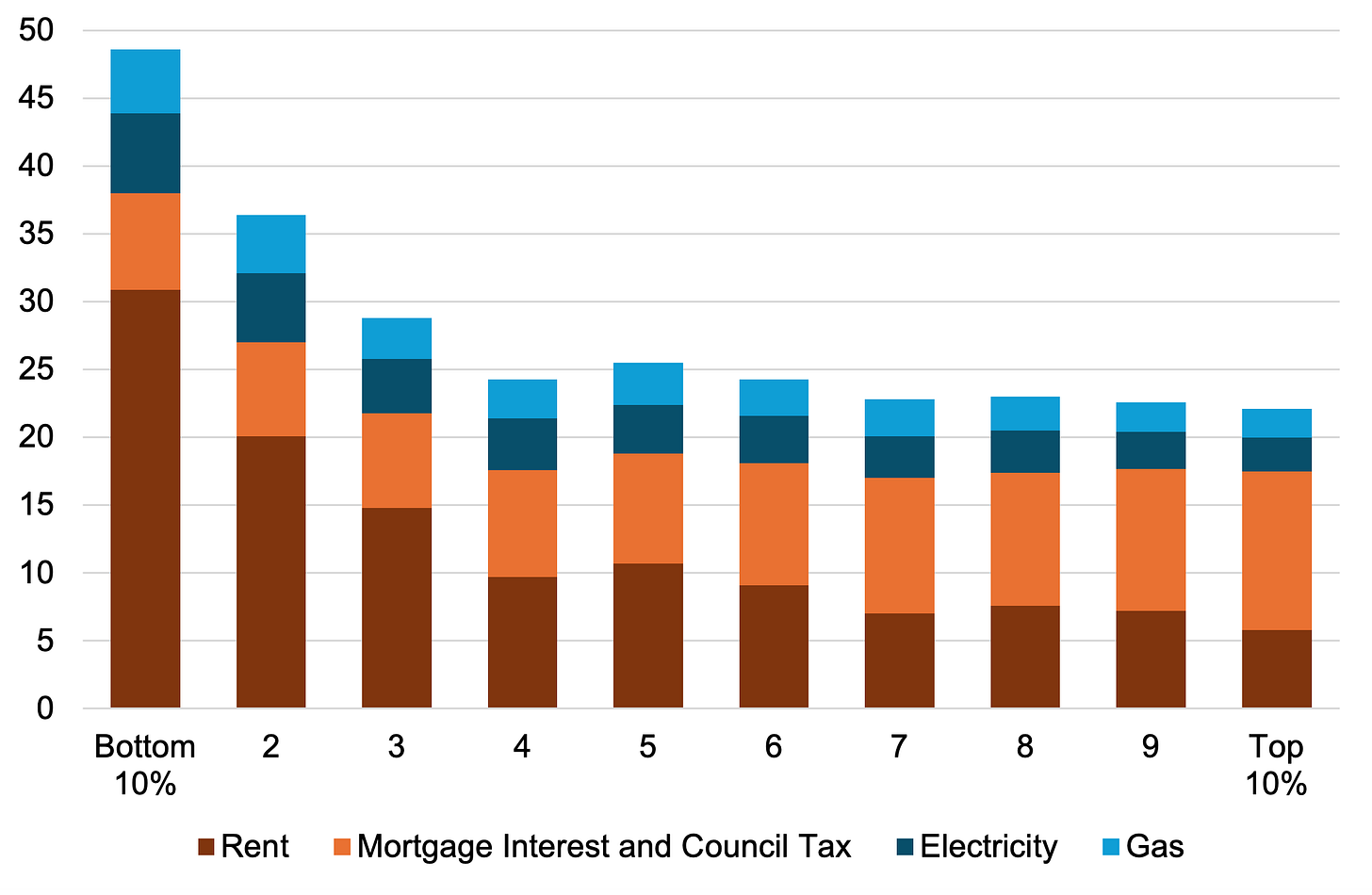

Getting costs down helps all households but helps low-income households the most because they spend more on essentials. The poorest 10% of households spend almost half of their disposable income on essential costs in the form of housing and energy bills. When these essential costs rise, as they did in the global living standards crisis, it hits the poorest the hardest. Inflation was 30% higher for the poorest households than it was for the richest in 2022. If we invest to get essential costs down, the poorest households benefit the most.

Figure 1. How much do households spend on the bare essentials?

The UK has higher prices for essentials than other nations. We have some of the highest energy, housing, and childcare costs of any high-income nation. We can, and should, act to get these costs down for households. To get the cost of energy, we should invest in clean energy (that is 50 to 75% cheaper than natural gas), insulate homes, and looking at other ways to reduce energy tariffs. We can get the cost of housing down by building more (social) homes. This will make an even larger difference to living standards as housing costs take up nearly two fifths of the incomes of the poorest. We can cap childcare costs as a proportion of income to get these costs down for lower and middle-income households. We, in Labour, can the pull the cost levers down to get living standards rising for all and for the poorest the most. We, in Labour, should do just that.

Incomes - Wages and Social Security Payments

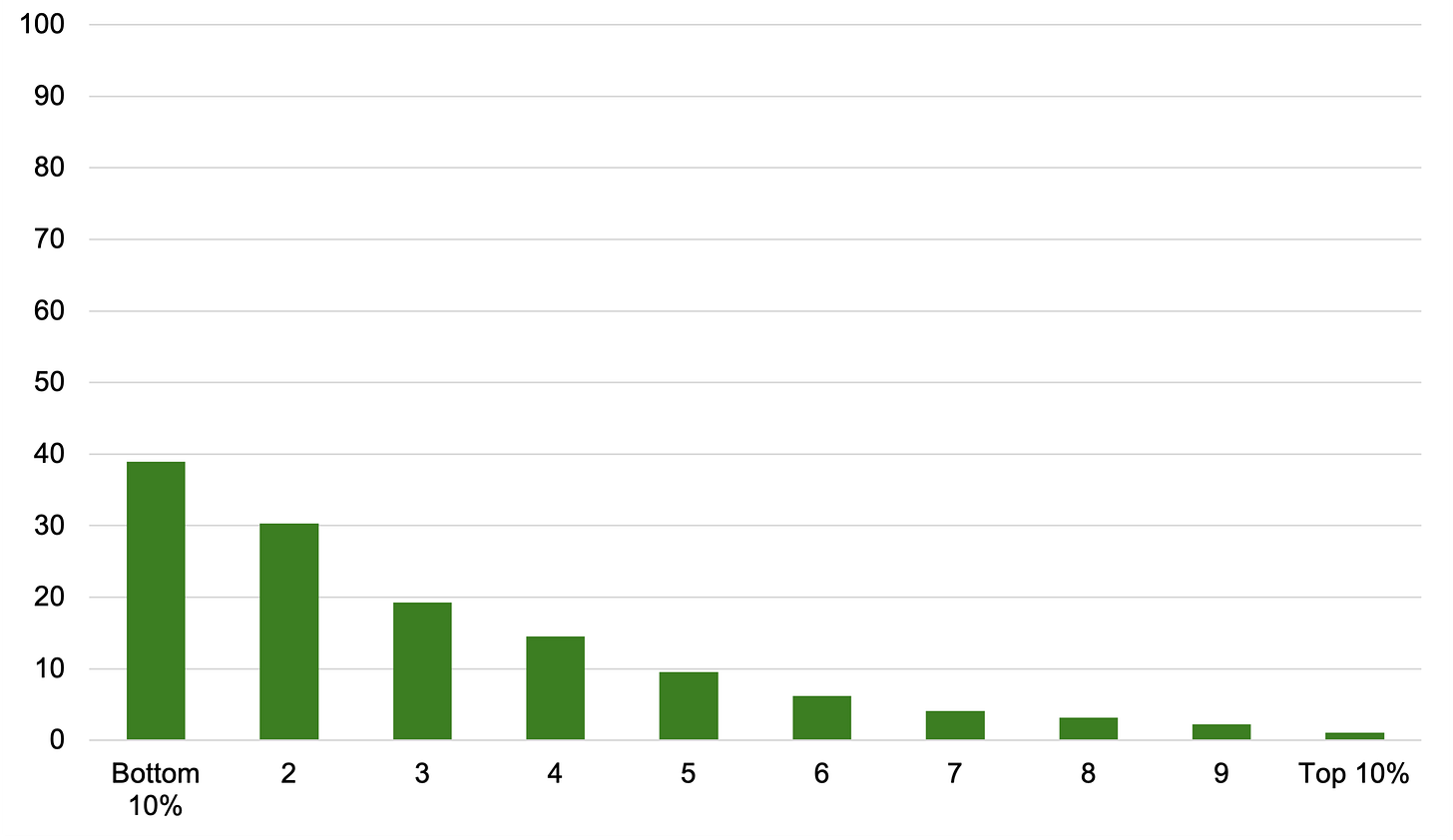

To understand how the wages and social security payment levers work, we need to first understand where households get their income from. Figure 2 below shows where working-age (i.e. non-pensioner) people get their income from. The key take-away is this: middle- and high-income households get most of their income from wages. Poorer households get more of their income from social security payments. The very richest households receive more of their income from investments and partnerships (which you can’t see in the below graph).

Figure 2. Where do working-age people get their income from?

Pensioners get far more of their income in social security payments.In Fig 3, all retirees receive social security payments, in the form of the state pension. But, middle- and high-income pensioners rely more on private pension and investment payments.

Figure 3. Where do retirees get their income from?

Source for Figs 1 & 2: ONS, 2023

Wages

Wage increases largely helps middle- and high-income working-age households with far less impact on those at the bottom. That is partly because low-income people are less likely to be working but it is mostly because poorer workers get their wages topped up by social security payments and these are withdrawn as they earn more.

Figure 4. What proportion of working-age people’s income comes from wages?

Source: ONS, 2023

Low-income households are less affected by wage increases because more of their income comes from social security payments, whether they are working or not. Remember Universal Credit is also an in-work social security payment. Around two-thirds of children in poverty are in working families and 60% of adults in poverty live in working households.

These universal credit payments are withdrawn at a rate of 55% as low-income workers earn more. They are also taxed on extra earnings as well. That is why rising wages helps low-income households, but not by much. For every pound that the minimum wage increases, those near the bottom (deciles 1, 2 and 3 on the graph below) keep only 17p. That is because 55p is withdrawn from universal credit payments, 20 p from income tax, and 8p in national insurance payments. Economic growth and rising minimum wages have far less impact on low-income households than they do for middle- and higher-income ones.

Middle- and high-income benefit far more from wage increases as they don’t face the effective 55% tax rate low-income workers do. There is, however, one group that do benefit less from wage increases: the young. New graduates face an additional income tax of 9% of everything they earn over £25,000.

Wage increases do help to raise living standards but we should be clear who they help and how. Governments can increase wages in the following: 1) economic growth (including from Bank of England interest rate cuts) generally feeds through to average wages, 2) increasing public sector wages directly gets wages rising, 3) income and national insurance tax cuts (but there is a productivity cost from lower government expenditure), and 4) increasing labour bargaining power helps workers get higher wages.

Social Security

If we want to reduce poverty, we have to increase social security payments. Poorer non-working and working households depend on social security payments for their income. Of those claiming Universal Credit, 2 in 5 are in work. For those at the very bottom, social security payments make up far more of their income. The poorest 10% of households receive 40% of their income in cash benefits – over 4 times the amount that those in the middle receive.

Figure 5. What proportion of working-age people’s income comes from social security payments?

Source: ONS, 2023

For low- and middle-income pensioners, social security payments in the form of the state pension, pension credit, and other payments makes up most of their income. Over half of all social security payments, and 13% of the total government expenditure, goes to pensioners social security payments. Richer pensioners rely far less on the state pension as they are so wealthy. Over a quarter of pensioners are millionaires.

Increasing social security payments to raise incomes and reduce poverty is, technically, very simple. It’s literally the stroke of a key. The key question is, of course how to pay for those increased payments.

When looking at this, we should also consider how increasing social security payments reduces other government spending pressures. People who are struggling financially are more likely to, for example, get sick and end up needing the NHS. Topping up their wages through universal credit means less health spending. Children from struggling families learn less today and earn less tomorrow. Social security payments represents both spending today and investment in tomorrow.

Conclusion

Living standards is the most important issue for voters. How we raise living standards differs for each part of the population as we can see in the table below. Levers that increase social security payments get more money into low-income households and for pensioners. Wage increases have little effect on these voters.

Table 1: How Living Standards Levers Affect Different Income Groups

To win the next election, we to win back economically insecure voters that have left us in droves, and show them that democracy delivers. To do this, we need to improve living standards. There are three levers to pull to do this. Getting wages rising, increasing social security payments, and getting costs down. Time to start pulling those levers.

I’m persuaded. The question is does this Labour government have the courage to make this happen?

Cutting pip is shameful though. It doesn't matter what else you do - you've literally made it so I'm unable to vote labour by picking on those least able to support themselves, and who actually need more help not less.