Russia's Wartime Economy Is Straining: Winning at War Economics (Part 1)

Beating Putin is a matter of resources and fighting forces

A century ago, politicians in my position did not prepare for war. We failed to show we had the resolve and resources to defeat a European dictator. And what followed was the most destructive war in the history of humankind. We cannot make that mistake again.

Winning wars is more a matter of resources than tactics. Specifically, it’s the side that can command greater resources and convert these into fighting forces that wins. We lost battle after battle at the beginning of World War II, but were still able to win because our economies were larger and could produce more fighting forces than Germany and her Allies. The same was true of North in the American Civil War. More resources converted to more fighting forces wins.

Of course, victory still depended upon not losing so badly in an initial phase that your adversary ends up capturing all your resources.

The key point is this: amateurs talk tactics, professionals talk logistics. If we show our adversaries we have the resolve and resources needed to defeat them, it also makes more war less likely. That is the deterrent effect.

Defeating and deterring Russia today follows that logic. Making sure we can bring more resources and fighting forces to bear than Russia can. We can win at war economics by limiting Russia’s ability to gain resources and convert them into fighting forces while, simultaneously, building allied resources and converting them into fighting forces.

In this post, I’ll set out where Russia’s wartime economy is today and how we can further reduce Putin’s resources and so his ability to produce fighting forces.

Russia cannot keep producing fighting forces in Ukraine at its current rate. It’s productive capacity is declining and its stocks are nearing exhaustion. But Putin can still win in Ukraine if he is able to bring more fighting forces to the battlefield in the months and years ahead. Ukraine is exhausted and is dependent on allied support and supplies.

When this war ends, Putin can use any pause to rebuild his own fighting forces. He will use the pause to rebuild his forces. He will come back for more. It’s our job to make sure Ukraine does not lose and Putin does not have more fighting forces than we do.

This is, however, a game of relative strength. Defeating Russia is a matter of their resources and fighting forces continuing to fall and our own increasing. This will be the first in a series of posts on War Economics. The next post(s) will focus on what the UK and our allies need to do in order to prepare for war.

War Economics differs from peacetime economics. Wartime economics is about a nation’s total GDP and total wealth as the resources it can bring to bear. Putin has taken the resources of Russia, and pushed them into fighting force production. This comes at a cost. Producing more guns today means less investment in other productive activities. It leads to more short-term economic activity at the cost of long-term productive ability.

Putin has transformed Russia into a wartime economy that is focused on producing fighting forces. Military expenditure takes up over 40% of the budget (and probably closer to half when everything is included). Its production of shells has increased fivefold while armoured vehicle production has doubled.

Putin’s key advantage going into this war was the resources his nation already had: in men, fossil fuels, cash, and Soviet munitions. But he is running down Russia’s fighting and material resources down at an unsustainable rate. On top of that, Western sanctions have helped to reduce those stocks. It is our job to keep degrading those resources so Russia cannot win.

So let’s look at Russia’s wartime economy. It is a picture of an economy that is nearing, but is not at, exhaustion. It’s ability to produce resources, and fighting forces, is falling. Its ability to buy what it needs from abroad is also declining. It’s running down its pre-war stocks of cash and munitions

Russia’s Production is Faltering

Demand is outrunning supply Putin is pushing economic activity into producing fighting forces. But his demand for fighting forces exceeds the ability of the Russian economy to supply it. That is leading to rapid rise in inflation - the official rate is around 10% but might be double that in reality. The loss of men coupled with rising demand has led to labour shortages, with unemployment at 2% and firms unable to find the people they need. Around 73% of firms are facing shortages of staff.

Source: https://cepr.org/voxeu/columns/russias-economic-war-propaganda

Productive Capacity is Falling The flipside of converting your economy into producing fighting forces in the form of men and material means the rest of economic production falls. Russia’s productive capacity is falling. The central bank has had to set interest rates at 21% (to defend the currency and get down inflation), and this also makes it harder for Russia to invest in other sectors of the economy.

Russia is finding it harder to buy what it needs from abroad

Sanctions on Russia’s imports mean they cost more The West imposed sanctions on exports like microchips that Putin could use in his war machine. That has had an effect with Russia using poorer quality microchips from consumer goods, like dishwashers, in its war material. Putin has been able to still gain some of these materials by importing them through third countries and other means. But it costs Putin money to evade those sanctions, and sanctions constitute an effective tax on his war machine.

Russia’s oil and gas revenues may be high (but they are still hit by sanctions) Russia’s large oil and gas reserves mean it has been able to gain dollars (and other hard currency) to pay for key war inputs. Europe and our allies have imposed steep sanctions that have worked to some degree. The profits Putin has been able to get from oil and gas fell in 2023. They rose slightly in 2024, but are likely to fall again in 2025. Our sanctions mean Russia is selling its oil and gas at a discount but, as will be discussed below, more can still be done.

Source: https://www.oxfordenergy.org/wpcms/wp-content/uploads/2025/02/Comment-Fiscal-Flex.pdf

Russia’s Stocks Are Declining

Running down Cash Reserves Russia’s ability to finance this war has involved running down its stocks of funds and resources. It’s run down the liquid assets in its own National Wealth Fund to the tune of around $50bn, which it has used to flatter its fiscal position into showing surpluses. Russia is struggling to borrow on domestic and international markets (and its 2022 default certainly did not help). The continued freeze of overseas Central Bank assets means that it has been unable to tap this source of funding either. The cash reserves that Putin built before war are frozen or running out.

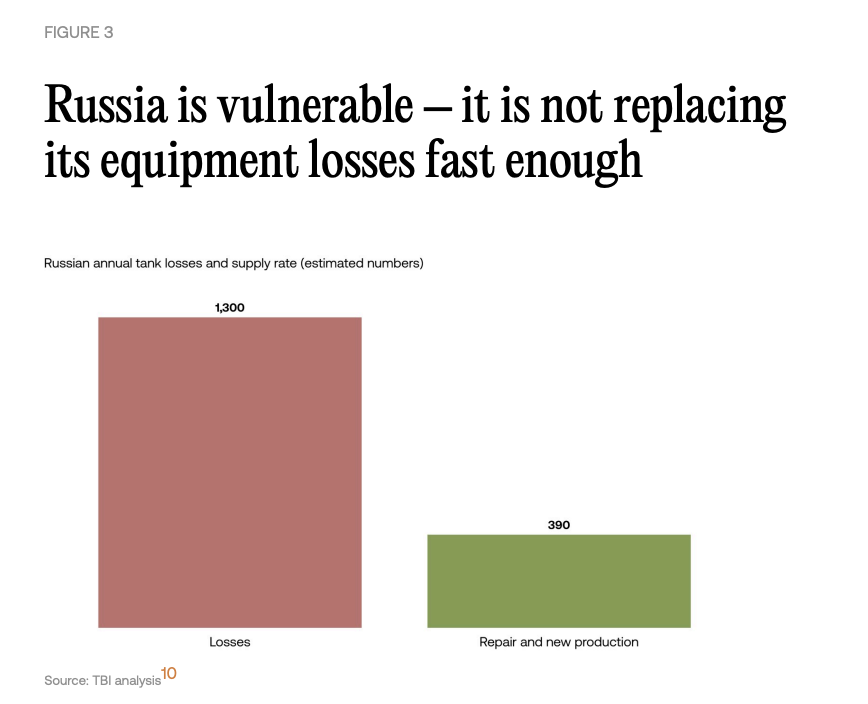

Soviet-era Fighting Stocks are falling (but it still has a lot of men) Russia is losing war material far faster than it can produce it. Is Soviet-era stockpile of munitions and vehicles is running low. Its artillery round advantage is also shrinking. Russia is unable to keep producing fighting forces to keep throwing into the conflict at its current rate. It does, however, have a lot of men it can keep throwing into Ukraine and future wars. Russia may have lost 500,000 men in Ukraine, but still has plans to grow its military to 1.5 million people.

Beating Putin at War Economics is a slow, grinding process. There is no silver bullet here. We cannot defeat Putin with any single clever policy or set of sanctions. There are, however, economic measures we can use to degrade his resources and fighting forces. Some of these economic measures are:

Strengthen oil price cap to further reduce earnings As Maximillian Hess has suggested, we can make it even harder for Russia to earn money from oil. Putin is currently profiting from oil by pretending Russian ships cost more to run than they actually do. Ports have little reason to check these costs correctly. Given that ports generally depend on London for insurance, we could make that insurance dependent on ports accurately assessing costs.

Strengthening sanctions on re-export of goods to Russia While Russia is banned from gaining Western imports of defence-critical goods like microchips, too many of these are still finding there way to Russia through third countries. Secondary sanctions of those who re-export these goods to Russia must be on the table.

Seizing Russia’s central bank assets We have frozen around $300bn of Russian central bank assets but have not yet seized them. It is time to seize them now for two reasons. Firstly, it deprives Putin of a potential source of cash stocks to rebuild Russia’s forces after Ukraine. Secondly, that money can be used to build allied fighting forces in the years ahead.

Taking those three actions will make it harder for Putin to gain resources and convert them into fighting forces. But none of this should lull us into a false sense of security. Defeating and deterring Putin is about more than degrading his resources, it is also a matter of building our own fighting forces to deter and defeat him.

In future post(s), I will turn to what the UK needs to do in order to convert our own resources into fighting forces. As we will see, this is about far more than what percentage of GDP we spend on defence. It is about our ability to rapidly convert our resources into fighting forces of our own.

The approach of this post makes me uneasy. There is no world government, and the UN cannot take this role. This means that we have to talk to people and governments we don’t like.

Above all, we have to try and stop wars. After 3 years, Ukraine is clearly losing, and more and more lives are being lost and destroyed. The Russians have made it clear for decades that a NATO presence in Ukraine is unacceptable. Nothing short of World War 3 will stop that. I don’t like Donald Trump, but if he can stop the killing and create some stability, I welcome it.

We need to be strong enough to repel an invasion, but we also need to be open to steps to de-escalate tensions. Trump seems to understand that to achieve his aims, sanctions should be part of the negotiating strategy to make a deal. In other words, they should be temporary. Instead, the post seems to be advocating permanent economic warfare against Russia. This won’t achieve behaviour change; all it can do is convince Russians that we are irreconcilable enemies.

The greatest improvement in human welfare in history occurred after 1980 when technology that had previously been confined to the rich countries was spread to many others. Over a billion people were lifted out of poverty. Economic sanctions and tariffs slow down that process.

Fully support your view that Europe needs to outmatch Russia in terms of military strength. However if Trump completely withdraws support there will be a problem in that much of NATO's forces are dependent on US supplied arms and technology which it may be impossible to rapidly emulated.

Whilst I agree that generally wars are one by the side that can deploy the most resources, making sure you invest in effective resources is important. The failure of the US to invest in the development of their torpedos prior to the attack by Japan, meant that many lives were lost and opportunities wasted as that resource was ineffective. Ukraine has demonstrated that expensive tanks and aircraft can be overcome with low cost weapons, so how you use superior resources effectively remains important.