During the Brexit debate, a distinguished academic stated that GDP would fall if we left the EU. Someone from the audience shouted, “That’s your bloody GDP, not ours.” The heckler had a point. When the economy (aka GDP) was growing, not everyone was sharing in it.

Growth has been going to high-earners (rather than low-earners), to capital (rather than labour), to London (rather than everywhere else), and to the old (rather than the young).

If we want everyone to share in growth, governments have to act to make it happen. In this post, I’ll set out why high-earners, capital, London, and the old have been gaining more from economic growth rest and how we fix that.

Let’s start with the basics: GDP measures total output in an economy. Economic growth is really important as it measures how much more prosperous our nation as a whole is getting.

But economic growth does not tell you who in the economy is benefiting from that growth. There is no law of economics that says “when the economy grows, all wages must grow equally within it” or “when the economy grows, each place is within a country is growing.” Whether economic growth benefits all is a matter of distribution.

In the decades after the Second World War, wages grew equally across people and places. But those days have passed. For the past few decades across high-income nations, when the economy has grown, it has only gone to some people and places. The top 1% gained a whole lot more of a (growing) pie than everyone else.

Let’s take a look at who’s been benefiting from growth in the UK over recent decades and how we make sure everyone shares in it from now on.

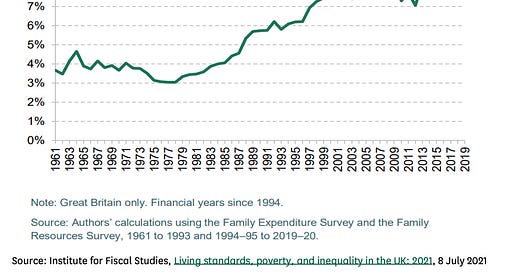

Top earners (gaining more than the rest)

Technological change led to high earners pulling away from mid- and low-pay earners. When the economy has been growing, it was top earners that gained more of that growth than everyone else. Average wages grew by 80% between 1980 and 2020, whereas top wages (at the 90th percentile) grew by about 120%.

Source: https://academic.oup.com/ooec/article/3/Supplement_1/i884/7259873#475782160

If we want all workers to share in earnings growth, then there are two broad strategies. Firstly, pre-distribution policies that raise earnings for middle- and lower-income workers such as skills training and minimum wage rises. Secondly, redistribution from the working rich to the working poor as New Labour did through tax credits.

2. Capital (gaining more than labour)

Economic growth, or the earnings from it, can go to two places - paid out in wages (to labour) or in the form of payments like dividends (to owners of capital). In high-income nations, the labour share has fallen as technological change led to machines being able to perform manufacturing tasks more cheaply than humans and as trade union bargaining power fell. (The two are related, I’ll maybe come back to this in future).

Source: https://www.ons.gov.uk/economy/economicoutputandproductivity/output/articles/trendsintheuklabourshare1997to2023/2024-11-25

If we want labour to gain a greater share of national income, then we need to invest in labour-intensive social infrastructure (like childcare) and raise worker bargaining power. This leads to more payments going to owners of labour (workers) rather than owners of capital.

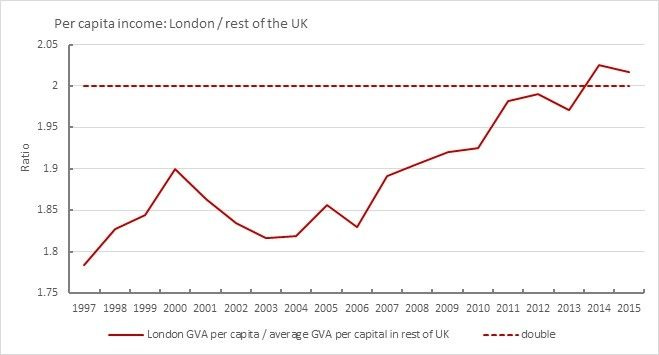

London (gaining more other places)

Major cities across the globe have taken a greater share of economic output as high-value production is now produced by lots of graduates working together in teams (think New York, San Fransisco, London). On top of that, the UK as the most politically centralised nation in the OECD is also the most economically centralised with three quarters of the highest paying UK jobs in London. Decisions made in London, benefit London.

Source: https://www.tuc.org.uk/news/london%E2%80%99s-economic-income-capita-double-rest-uk

If we want places outside of London to benefit from growth, then we have to invest outside of London. The East Midlands, where I’m based, has the lowest transport infrastructure spending in the country - we receive two and a half less times per person than London does. We also need a lot more devolution of money and powers away from the capital.

Old (gaining more than young)

Older generations purchased houses cheaply decades ago and we haven’t built enough houses (in major cities where the good jobs are). Older generations have then benefited as the demand for those houses grew more quickly than new ones were built. Add in two major economic crises that have blighted the young of today (financial crisis of 2008 and pandemic) and some of the policy decisions of the last government (like actively raising taxes for graduates), and you get a generation that doesn’t have a fair shot at a decent life.

Build, build, build a lot more homes (where the good jobs are) to get prices down for young people. We also need to start actively tilting policy to make life affordable for young people so they can afford to have families (like previous generations did).

That is a very quick tour of why everyone hasn’t shared in growth and how to make it so. Economic growth does not automatically benefit all people and places, but we can build a country where it does.

Interesting posts. What are your thoughts on an annual wealth tax - perhaps a 1% tax on assets over £10 million? Do you think capital flight would be a real issue if this were implemented? Are you familiar with Gary Stevenson and his campaign?

Love this explainer Jeevun!