In a previous post, one of us (Jeevun) wrote about how we can Reduce Extreme Poverty for Free through debt relief. In this post, we (Jeevun and Gideon) want to introduce you to another way we can reduce extreme poverty for free: by re-channelling money that the International Monetary Fund (IMF) has given us to poor countries that need it to invest in their development. This money is in the form of ‘SDRs’, or Special Drawing Rights. If we followed the example of Spain, and re-channelled 50% of our SDR allocation, this would mean between £9 billion and £36 billion more for low-income nations. And we can do this for free.

What are Special Drawing Rights?

SDRs are an asset, which we can think of as money, that have been issued by the IMF to every country across the world. The IMF created a lot of this money after COVID, £470bn to be precise, to nations struggling with the financial effects of the pandemic.

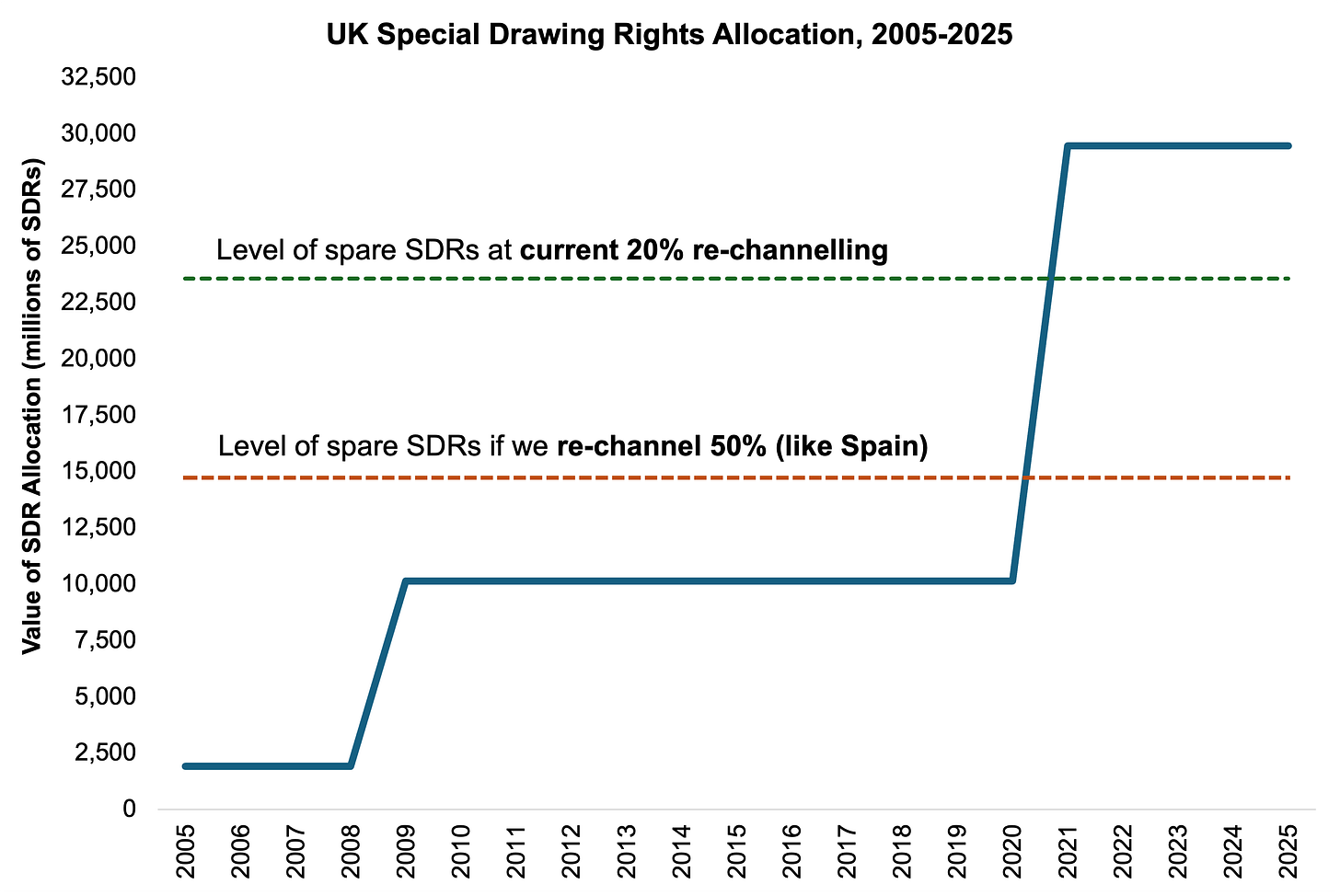

SDR assets can be exchanged between countries that hold them and converted into hard currency – US Dollars, Pounds Sterling, Japanese Yen, Chinese Renminbi, or Euros. Each country is allocated this money in proportion to the size of their economy1. The UK currently has 29.5 billion SDRs, roughly equivalent to £30.4 billion (up from £10.4 billion in 2020). The USA has £118.2 billion. A low-income nation like Guinea only has £316 million.

The UK now has large stocks of SDRs (over £19 billion more than before) that we can exchange for currencies including pounds. If we do exchange or use them, however, we have to pay an interest charge on them. This means converting them into cash would cost the UK money.

We don’t use these SDRs for our own financing needs. Instead, we do things with the SDRs the IMF has given us. Either we re-channel them to low-income nations through IMF funds, or we let them sit idle in a UK bank account.

How can SDRs reduce extreme poverty?

We can turn our SDRs into cheap loans to the poorest countries, so they can invest in their development.

We do this through ‘re-channelling’ – loaning our SDRs to developing countries, via the IMF. This costs us nothing because we can loan these out at the SDR interest rate. This is something the UK already does: we have re-channelled 20% of our SDRs so far. But peer countries have gone further. Japan and the Netherlands channel 40%. Spain channels 50%. If we adopted Spain’s policy, we could provide up to £36 billion in extra funding.

There are two ways to do this. An easy way and a harder way.

The first way, the easy way, is to do more of what we do already. We can channel SDRs through two trusts, operated by the IMF, that provide loans at low or zero rates of interest with long repayment periods to low-income countries. These are the Poverty Reduction and Growth Trust2 and the Resilience and Sustainability Trust. We already do this, but if we adopted Spain’s policy & loaned 50% of our SDRs, we could increase the lending provided by £9 billion.

The second way is harder but more effective. We could quadruple every pound we put in, if we instead loaned our SDRs to Multilateral Development Banks like the World Bank. These are organisations set up to provide resources to poor countries, and can use the SDRs we provide to raise further private finance. We could even turn a profit, and increase the liquidity of our reserves by doing this.

This way is harder because we need our allies to act with us and do the same thing. The IMF regulates the lending of SDRs to Development Banks, and have stipulated that at least five countries must act in concert to open up this mechanism. By working with allies, we could raise £36 billion4 for the poorest countries from UK funds alone. This is almost three times the overseas aid budget.

Why aren’t we using more of our SDRs to help reduce extreme poverty?

We currently re-channel 20% of our SDRs. We could re-channel 50% like Spain. The reason we don’t is because we are over-insuring for a risk we do not face.

SDRs are assets are designed to provide emergency funds to nations in times of crisis. If a country has run out of dollars and cannot cover the cost of imported goods, it can exchange SDRs for dollars. If the UK were to need these emergency funds, it could recycle SDRs to get them.

But, here’s the thing, this is not a problem the UK will ever have. The pound is one of the most stable currencies in the world, and UK government debt amongst the most trusted. It’s so safe that you can exchange SDRs for pounds. We will not need any emergency hard currency because we are hard currency. We struggle to think of a situation where we need our SDRs for own financing needs beyond a catastrophic scenario where they wouldn’t be much use anyway (e.g. if an asteroid hit us).

Even if you buy the argument that we need 80% of SDRs for future financing needs, after the IMF’s 2021 allocation, we now have 19 billion SDRs more than before. If we lend out 50% of the SDRs currently allocated, we’ll still hold nearly £5 billion than we did before Covid and £28.2 billion more than before the Financial Crisis.

Fig 1. If we re-channel SDRs like Spain, we would still have nearly £5 billion more to use in an emergency than before 2021.

Source: International Monetary Fund and authors’ calculations

In a time when public funds are scarce, we need to find innovative ways to help end extreme poverty. SDR re-channelling is something we could start today, to provide billions for developing countries to spend on building new roads, vaccinating their children, and creating jobs for their people. And we can do this for free.

It’s precisely in proportion to their IMF shareholdings, but let’s not get too caught up in the detail here.

For the case of the Poverty Reduction and Growth Trust (PRGT), loans disbursed by the IMF are done so at an interest rate of 0%, with the interest charge refunded from a subsidy fund, which is financed by a range of donor countries from their ODA budget. Crucially, the amount committed into the subsidy fund is not related to the amount of SDRs re-channelled through the PRGT.

I find international economics quite frustrating because I don't know enough about it. Thanks for explaining.

Interesting idea my fear is always the mismanagement of funds through corruption and inefficiency. We have seen this numerous times through Aid and development funds.